Medical Insurance Market Overview, Growth Analysis, Trends and Forecast By 2029

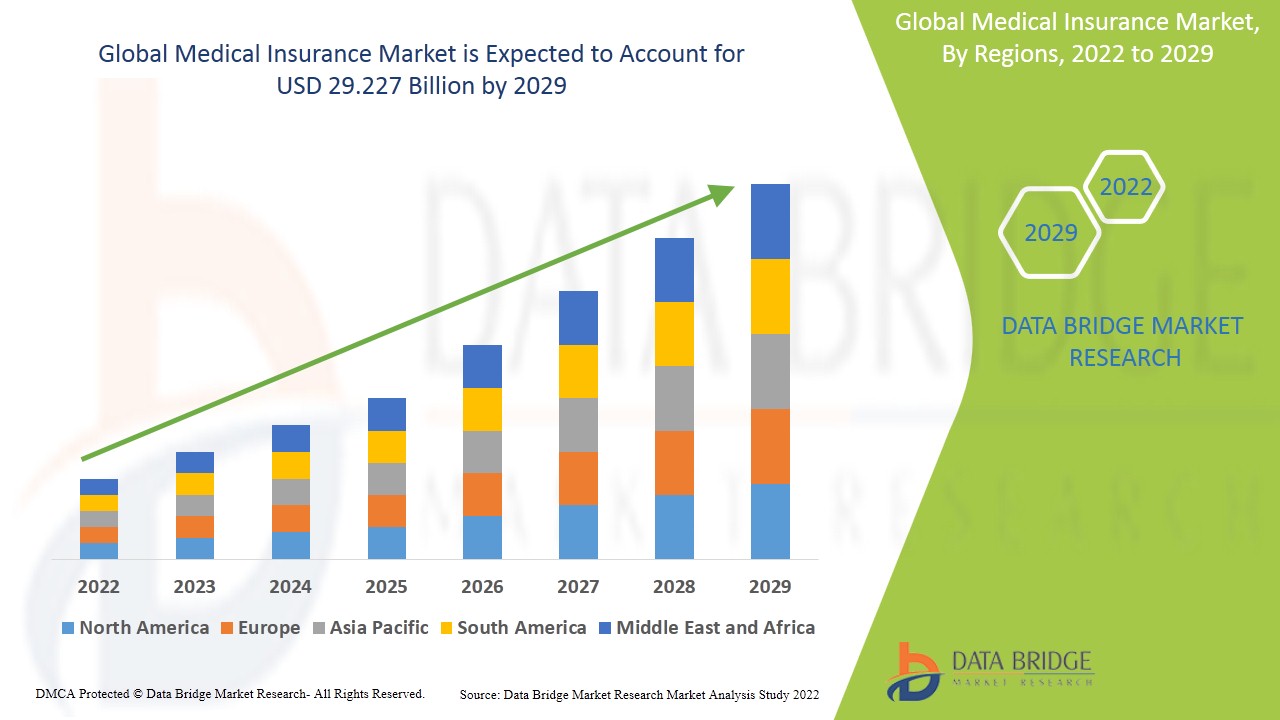

Data Bridge Market Research analyses that the medical insurance market to account USD 29.227 billion by 2029 growing at a CAGR of 10.30% in the forecast period of 2022-2029.

Executive SummaryMedical Insurance Market:

Data Bridge Market Research analyses that the medical insurance market to account USD 29.227 billion by 2029 growing at a CAGR of 10.30% in the forecast period of 2022-2029.

Medical Insurance Marketreport is offered to the business with a complete overview of the market, covering various aspects such as product definition, market segmentation based on various parameters, and the customary vendor landscape. All statistical and numerical information given in the report is symbolized with the help of graphs and charts which facilitates the understanding of facts and figures. All the data and information collected for research and analysis is denoted in the form of graphs, charts or tables for the sensible understanding of users. The Medical Insurance Marketreport defines CAGR value fluctuation during the forecast period of 2019 - 2025 for the market.

This Medical Insurance Marketreport is composed of myriad of factors that have an influence on the market and include industry insight and critical success factors (CSFs), market segmentation and value chain analysis, industry dynamics, market drivers, market restraints, key opportunities, technology and application outlook, country-level and regional analysis, competitive landscape, company market share analysis and key company profiles. This global Medical Insurance Marketbusiness report is very reliable as all the data and the information regarding the industry is collected via genuine sources such as websites, journals, annual reports of the companies, and magazines.

Discover the latest trends, growth opportunities, and strategic insights in our comprehensive Medical Insurance Market report. Download Full Report:https://www.databridgemarketresearch.com/reports/global-medical-insurance-market

Medical Insurance Market Overview

**Segments**

- By Type:

- Health Maintenance Organizations (HMOs)

- Preferred Provider Organizations (PPOs)

- Exclusive Provider Organizations (EPOs)

- Point of Service (POS)

- By Provider:

- Public

- Private

- By Coverage:

- Individual

- Family

- Group

The global medical insurance market is segmented by type, provider, and coverage, providing a diversified outlook on the industry. Health Maintenance Organizations (HMOs) are prevalent in the market, offering comprehensive coverage through a network of healthcare providers. Preferred Provider Organizations (PPOs) give policyholders the flexibility to choose healthcare providers within or outside the network. Exclusive Provider Organizations (EPOs) limit coverage to healthcare providers within the network, ensuring cost-effective services. Point of Service (POS) plans combine features of HMOs and PPOs, allowing members to select primary care physicians and obtain referrals for specialists. On the provider front, the market consists of both public and private players, each catering to different consumer segments. Public providers often focus on subsidized or government-sponsored insurance schemes, while private providers offer a wide range of customizable plans for individuals, families, and groups.

**Market Players**

- UnitedHealth Group

- Anthem, Inc.

- Cigna

- Aetna

- Allianz Care

- AIG

- AXA

- Aviva

- Berkshire Hathaway

- Zurich Insurance Group

The global medical insurance market features a competitive landscape with key players such as UnitedHealth Group, Anthem, Inc., Cigna, Aetna, and Allianz Care leading the industry. These market players offer a range of insurance products and services catering to the diverse needs of consumers worldwide. AIG, AXA, Aviva, Berkshire Hathaway, and Zurich Insurance Group are also significant players in the market, providing innovative insurance solutions and expanding their global presence. With the increasing demand for quality healthcare services and the rising awareness of the importance of medical insurance, these market players are continuously adapting to market trends to stay competitive and meet the evolving needs of customers.

The global medical insurance market is experiencing significant growth and transformation, driven by various factors such as increasing healthcare costs, rising incidences of chronic diseases, and a growing emphasis on health and wellness. One of the emerging trends in the market is the shift towards value-based care and outcomes, where payers are incentivizing providers based on the quality and effectiveness of care delivered rather than the volume of services provided. This trend is reshaping the traditional fee-for-service model and encouraging collaboration between insurers, healthcare providers, and patients to achieve better health outcomes.

Another key trend shaping the medical insurance market is the adoption of technology and digital innovation. Insurers are leveraging advanced analytics, artificial intelligence, and telemedicine to streamline operations, improve customer engagement, and enhance the overall healthcare experience. Digital platforms and mobile apps are empowering consumers to access healthcare services remotely, receive real-time health information, and make informed decisions about their care. This digital transformation is driving efficiency, reducing administrative costs, and enabling insurers to offer more personalized and convenient insurance solutions to meet the evolving needs of policyholders.

Furthermore, the COVID-19 pandemic has underscored the importance of medical insurance and highlighted the need for comprehensive coverage against unforeseen health risks. The crisis has accelerated the adoption of telehealth services, remote monitoring solutions, and virtual care platforms, prompting insurers to expand their coverage options to include these innovative technologies. In response to the pandemic, insurers have also introduced new benefits such as coverage for COVID-19 testing and treatment, telemedicine consultations, and mental health support to address the evolving needs of policyholders in a rapidly changing healthcare landscape.

Looking ahead, the global medical insurance market is poised for further growth and innovation as insurers continue to adapt to changing consumer preferences, technological advancements, and regulatory developments. The industry is expected to witness increased consolidation, partnerships, and collaborations among insurers and healthcare providers to create a more integrated and value-based healthcare ecosystem. As consumer demand for affordable, accessible, and high-quality healthcare services continues to rise, insurers will need to focus on delivering innovative insurance solutions that prioritize preventive care, chronic disease management, and overall well-being to stay competitive and address the evolving needs of a diverse and dynamic market.The global medical insurance market is witnessing a paradigm shift towards value-based care, where insurers are incentivizing providers based on healthcare outcomes rather than the volume of services rendered. This strategic approach promotes collaboration between payers and providers to enhance the quality and efficiency of healthcare delivery, leading to better health outcomes for patients. Additionally, the market is embracing technological innovations such as advanced analytics, artificial intelligence, and telemedicine to revolutionize the insurance landscape. Insurers are leveraging digital platforms and mobile applications to offer personalized insurance solutions, improve customer engagement, and streamline operations, thereby enhancing the overall healthcare experience for policyholders.

The COVID-19 pandemic has accelerated the digital transformation in the medical insurance sector, highlighting the importance of comprehensive coverage against unforeseen health risks. Insurers have introduced new benefits and expanded their coverage options to include telehealth services, remote monitoring solutions, and mental health support to address the evolving needs of customers during the crisis. This shift towards digital health solutions has not only improved access to care but also enabled insurers to deliver efficient and cost-effective healthcare services, ensuring continuity of services during challenging times.

Moreover, the market is witnessing increased consolidation, partnerships, and collaborations among insurers and healthcare providers to create an integrated healthcare ecosystem focused on value-based outcomes. As consumer demand for affordable and high-quality healthcare services grows, insurers are prioritizing preventive care, chronic disease management, and overall well-being in their insurance offerings. By aligning with evolving consumer preferences and regulatory developments, insurers are poised to drive innovation in the medical insurance market and meet the diverse needs of a dynamic customer base effectively.

In conclusion, the global medical insurance market is undergoing a transformation driven by changing consumer expectations, technological advancements, and the impact of the COVID-19 pandemic. Insurers are embracing value-based care models, digital innovations, and strategic partnerships to enhance the quality, accessibility, and affordability of healthcare services. By focusing on delivering customer-centric insurance solutions that prioritize preventive care and holistic well-being, insurers can position themselves as market leaders and adapt to the evolving healthcare landscape successfully.

The Medical Insurance Market is highly fragmented, featuring intense competition among both global and regional players striving for market share. To explore how global trends are shaping the future of the top 10 companies in the keyword market.

Learn More Now:https://www.databridgemarketresearch.com/reports/global-medical-insurance-market/companies

DBMR Nucleus: Powering Insights, Strategy & Growth

DBMR Nucleus is a dynamic, AI-powered business intelligence platform designed to revolutionize the way organizations access and interpret market data. Developed by Data Bridge Market Research, Nucleus integrates cutting-edge analytics with intuitive dashboards to deliver real-time insights across industries. From tracking market trends and competitive landscapes to uncovering growth opportunities, the platform enables strategic decision-making backed by data-driven evidence. Whether you're a startup or an enterprise, DBMR Nucleus equips you with the tools to stay ahead of the curve and fuel long-term success.

Key Pointers Covered in the Medical Insurance Market Industry Trends and Forecast

- Medical Insurance Market Size

- Medical Insurance Market New Sales Volumes

- Medical Insurance Market Replacement Sales Volumes

- Medical Insurance Market By Brands

- Medical Insurance Market Procedure Volumes

- Medical Insurance Market Product Price Analysis

- Medical Insurance Market Regulatory Framework and Changes

- Medical Insurance Market Shares in Different Regions

- Recent Developments for Market Competitors

- Medical Insurance Market Upcoming Applications

- Medical Insurance Market Innovators Study

Browse More Reports:

Global Polyamide-imide Resin Market

Global Callus treatment Market

Global Antibiotics in Animal Feed Market

Global Antihypertensives Market

Global Cross Laminated Timber (CLT) Market

Asia-Pacific Corrosion Monitoring Market

Global Instrument Cluster Market

Global Acid Sphingomyelinase Deficiency Drugs Market

North America Paper and Paperboard Packaging Market

Global Primary Mediastinal Large B-cell Lymphoma Treatment Market

Global Reverse Osmosis (RO) Water Purifier Market

Belgium Insulation Market

Global Marine Shackle Market

Asia-Pacific Ashwagandha Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:-corporatesales@databridgemarketresearch.com